How to plan a family budget: step-by-step guide

Planning a family budget is a key skill for achieving financial stability and success. In this guide, we will explore a step-by-step approach to creating an effective family budget.

The first step in budget planning is to accurately identify all sources of family income. Include salaries, bonuses, investment income, social benefits, and any other regular income.

- The basic salary of all working family members

- Additional income from part-time work

- Passive income from investments or renting out

- Government payments and allowances

Divide all expenses into categories for better control. This will help you identify areas where you can optimize your spending and find opportunities for savings.

- Rent/mortgage

- Public utilities

- Food products

- Transport

- Entertainments

- Restaurants

- Hobby

- Shopping for clothes

Use the 50/30/20 rule: 50% of your income for essential expenses, 30% for desires and entertainment, and 20% for savings and debt repayment.

| Category | Planned amount | % of income | Notes |

|---|---|---|---|

| Housing | 40,000 rubles | 40 % | Rent + utilities |

| Food | 20,000 rubles | 20 % | Groceries and restaurants |

| Transport | 10,000 rubles | 10 % | Gasoline, maintenance |

| Entertainments | 10 000 rubles | 10 % | Movies, books, hobbies |

| Savings | 20 000 rubles | 20 % | Savings and investments |

| Total | 100 000 rubles | 100 % | Monthly income |

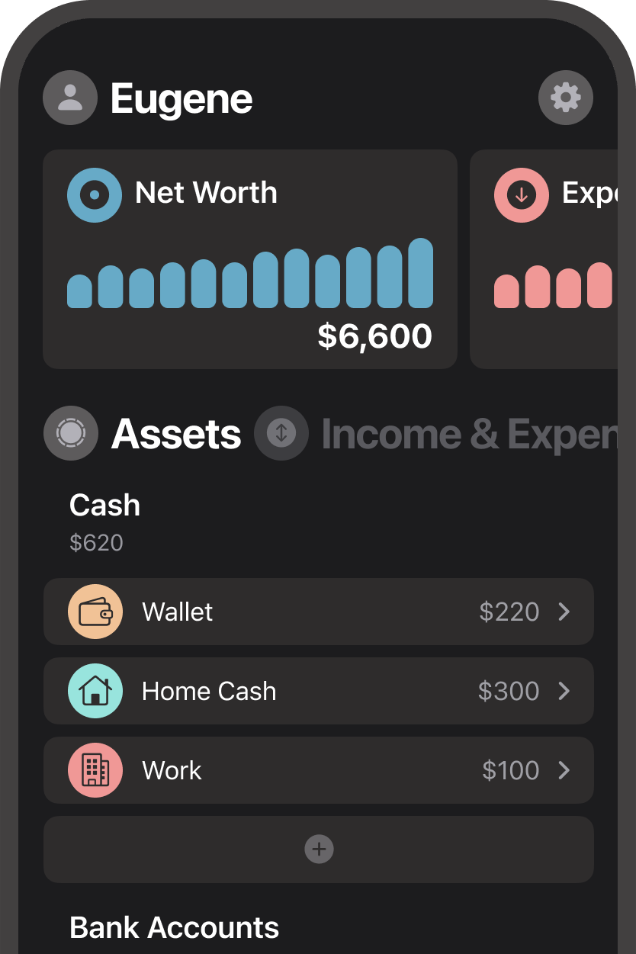

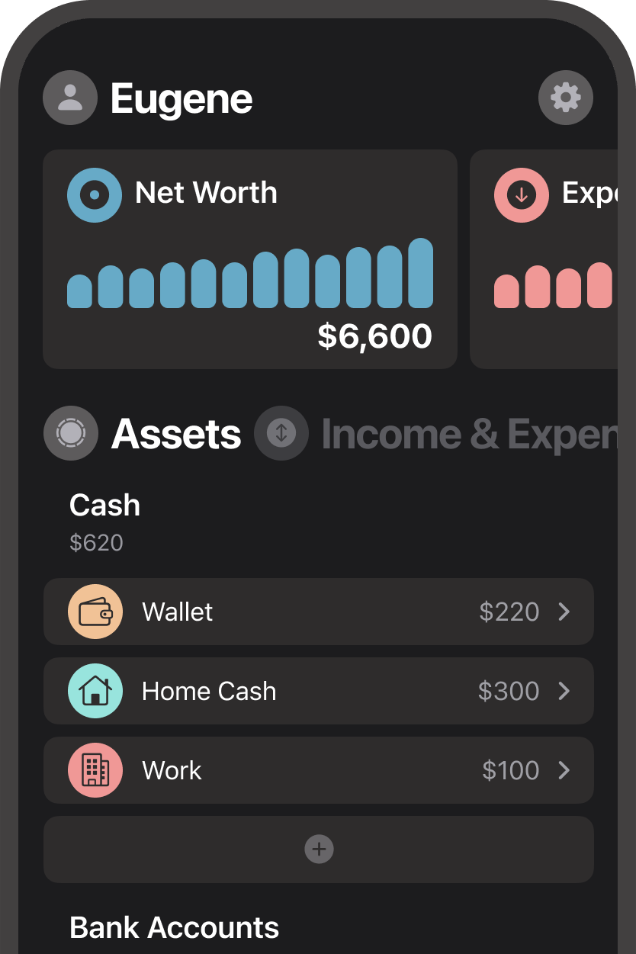

Use mobile apps to automatically track your expenses. This will help you know exactly where your money is going and adjust your budget accordingly.

- Review your budget every month

- Create a reserve fund for 3-6 months

- Automate your savings

- Track all your expenses, even the small ones

Planning a family budget is a skill that develops with practice. Start with a simple plan and gradually improve it. Remember that the goal of a budget is not to limit you, but to give you the freedom to achieve your financial goals.

We use cookies

This website uses cookies and analytics tools to improve your browsing experience and analyze website performance. You can manage your cookie preferences in your browser settings.

Start managing your finances today

Join the community of people who are already managing their finances confidently and effectively with CoinIQ